IMF Working On A Global CBDC Just in Time For the Global Bank Failures on the Horizon

You can listen below or download the file to listen on any device.

Please know that this is a computer generated transcript and thus may not be transcribed with complete accuracy or spelling and may have grammatical errors.

This transcript is sponsored as a public service of the Worldview Weekend Foundation. Thank you for your contribution to www.wvwfoundation.com so we can continue to offer this FREE service.

You can also send your contribution to:

Worldview Weekend Foundation

P.O. Box 1690

Collierville, TN 38027

Brannon Howse: All right. Welcome. Glad you are with us. Going to be joined tonight by Rebecca Walser. And then we're going to be joined by attorney Matt Deperno. Are they about to criminalize Christianity in Michigan? The answer is yes. 1965 repressive tolerance was a paper written by none other than Herbert Mukooza. He coined the phrase Make love, not war. He was part of the Frankfurt School and writing and spoke about these people for nine years. Well, I don't know how many years I got to do the math. First conference I ever held at the Frankfurt school was in November of 1997. So I've been talking about cultural Marxism to the point that some of my audience, I think they were going to lose it because I talked about cultural Marxism so much. In fact, I remember being criticized online by some of the, you know, the detractor's house. All he ever talks about is cultural Marxism, cultural Marxism. Well, that was before anybody really knew what it was. But now everybody is an expert on cultural Marxism. Well, one of the founders of cultural Marxism, Herbert Marcuse, 1965 wrote a paper saying that we're going to be more intolerant than the right. And in doing so, we will take away their freedom of speech and the right to public assembly. Michigan is looking at legislation that would send you to jail should you hurt the feelings of any protected minority class like the LGBTQ transgender group If you hurt their feelings, when's the last time you ever heard of someone going to jail or being fined because they hurt the feelings of a Christian or an America First proponent, a MAGA person, a Trump supporter? Or how about hurt the feelings of a Jewish person, all the raging anti-Semitism out there? Isn't it always the other side that wants? Protection.

Brannon Howse: Those opposed to the Judeo-Christian worldview. But it's open season for those who embrace the Judeo-Christian worldview. Check in with Matt Deperno. What's going on in Michigan? They will be joined by Patrick Wood. Patrick Wood of Technocracy. Been a couple of weeks since we've checked in with him. And then at 940 Central, I'm sorry, 840 Central 840, Central nine 440 Eastern, Roger Stone joins us. You're not going to want to miss what Roger has to say. I just hung up with Roger. Before we go to Rebecca Walser, let me tell you, folks, this is the number one of the number one best sellers on our website right now. I asked Caleb, our warehouse manager, what are our best sellers. He said, Well, Mister be one of them. Is the the candle, the 100-hour candle? And I don't know if you can hear that, but there's there's a liquid in there. And if you go to the website, it explains exactly what it is and it doesn't put off an odor or anything it's safe to use inside.

Brannon Howse: It's a 100-hour candle. Those that's one of the most popular things right there. Um, what else is popular? This is popular and this is how it folds up. It's a little it's flat, but what it is, it's a single burner folding stove. I'm not going to open it because someone's going to want this, but you open it up and it's got these legs that open up. Obviously, you know how it works. And so then you put a six-hour canned heat under it. Now you can boil water. To make freeze-dried food. I mean, you don't have to take a lot of space to have some good emergency supplies. In fact, this might be the kind of thing you want to throw into a bag and put in the back of your car. For those of you that live in areas where you might get snowed in, know, you get in, caught in traffic or snowed in somewhere, You hear about these stories, right. And well, you could heat a. A whole little thing of water and have your freeze-dried food in your emergency kit and keep all that in a backpack. We also have, of course, the suture kits for stitches. These are these are great to add to the EMT bag because I went looking for them. After all, I wanted more sutures. I didn't think I had enough sutures in the EMT kit. I wanted more. And so I went and found this extra additional suture kit.

Brannon Howse: So you'll find that to add on your own website at WVWTVStore.com. And then you can just button it all back up and there you go. Now you're like, I don't know how to do sutures. Brannon Yeah, you may not. I don't, but I have doctors and nurses. Et cetera. In my neighborhood. And if something happens and I can't get to the hospital and we need stitches, we have an EMT bag, and we've added in the extra sutures, you can add to it. I actually have a red one around here somewhere. What happened to the red one, guys? Oh, here it is. It's at my feet. Hang on. Yeah, that's way up under there. Here's a red one. I think this is what we have right now. I think the blue is sold out. So right now it's all going to be red with the blue with the white Cross. So there you go. So you get the EMT bag and then you add the extra suture kit with it. You add some of the blood clot. I thought I had a bag of the blood clot up here, guys. I thought you guys. Yeah, I do. Look at that under the table. Here we go. Blood clot powder, emergency first aid, blood clot, plus antibiotic. There you go. I would add that to my emergency EMT bag as well. And I got a lot of stuff under the desk here.

Brannon Howse: I got to show this. Oh. You know, like all these little knickknacks. I asked them to throw all this stuff under the desk. I thought it was here. Let's see here. Here. This was my wife's idea for tray seed. Sprouter for tray seed Sprouter. And if I hadn't knocked the seeds on the ground, the container, I would show them to you. But you go to our website, wptv.com and you'll see that you can put the seeds in these and grow your sprouts, grow your own sprouts. Very nutritious, and very tasty. I understand some people add them to salads and make sandwiches out of them. Of course we have the potassium iodide to protect your thyroid in the event of a nuclear event, which, as you heard in my report tonight, Putin is threatening to let go of his Satan which can have up to 15 nuclear devices on it. We have the colloidal silver that's available there on our website. Ww wptv.com. We've got the 2400-calorie emergency rations 2400 calories. Again, I would stick this in an emergency to-go bag or or in a backpack that I put in the back of my car. If I lived in areas where you might be prone to having a problem, where you get a lot of snow folding solar power with a power bank, that's very popular as well. We also have another one over here.

Brannon Howse: This is the charger and 20 Led room light. That's solar-powered solar. Powered that that light and that battery are so those are very popular. Let's see. What else do we get that's popular? Oh, this is a really popular one. The pop-up solar charger lantern, it you can make it rather. It's pretty small already, as you can see, but you can compress it down and then pop it up. That's solar. That's solar. Let's see, what else have I got? Anything else under here, boys? Oh, yeah, Yeah. Here we go. Oh, this is the insta fire. This is a two gallon insta fire for those who are using the outdoor stove. But you don't want to have to run around trying to find a way to get some. Paper. What are you going to do to get your fire going? You use the instant fire. That's all there. So I guess that's about it. Tonight I wanted to show those. I have all kinds of stuff on the floor around me. But anyway, there you go. That's all available at WDW TV store.com. Or you can call 901 4689357. Okay. A service we offer to you and in return you're helping us because this is how we a big part of our general operating budget. All right. Joining me now is Rebecca Walser. Rebecca, welcome back to the broadcast. Thanks for joining us. We're glad to have you on board. Thank you.

Rebecca Walser: Glad to be here.

Brannon Howse: So what is in the news today? Before I go to some news stories, I got what's in the news today that you think our audience needs to know about.

Rebecca Walser: So what I'm seeing is and it's been happening, but I really wanted to to speak to the audience and just really get people kind of just stay friendly warning, if you will, because what we're starting to see is kind of a shifting of the narrative from a little bit from reality, which is not unusual. But let me explain what I'm saying. So today, the ten year and the two-year, now they have been inverted, Brannon, for a long, long time. And so anytime you have an inverted yield curve to explain that to the audience, your short term rates are always usually in a normal economic environment less than your long-term rates. Because if you're going to lock up your money, your capital for a longer period, you have to have a higher rate to attract you to lock it up for longer. Why would we lock up money for ten years unless we were going to get a higher guaranteed return for those ten years? Then we would get on a two year. So usually short term ratesare lower than longer-term rates. That's the normal economic way. We've had inverted rates, meaning that the two year and the three-year have been paying more than the ten year for an extended period. But as those rates start to move apart further, that indicates more problems coming. And what we see right now is that the two-year and the ten year are inverted, almost one, almost basically a full point, a hundred basis points. They're right at 98 to 99. And that's really alarming. We have a lot of other things that have happened. And the reason I'm saying all of this to the audience is that technically speaking, we are now officially back into a bull market.

Rebecca Walser: And so you're going to hear Wall Street pound this into the sand and get people to come back into equities or into fixed income bonds and say, hey, we've sort of turned this corner. You know, you're missing the boat if you're not in stocks and bonds. And there's this real pressure that's building now on the average investor to think that everything is past and it's time to get back in. And I just want to caution the audience that that is not the case at all. And this is, I think, probably Custard's last stand before the economy really does have its day in court that we've been waiting on. And let me just give you one additional fact here. I could give you 20. Brannon, just to give you a concept, I would just tell you that right now we have short sellers in the economy that have shorted more than $1 trillion. This is the largest short position since April of 2022. So what that means is the short sellers are the hedge institutional money. The institutional money really runs the world and the institutional money is betting against this market, the largest bet against this market since April of last year. So please, folks, when you look at the VIX, which is the volatility index indicator, the fact that it's less than 14 right now is an anomaly. I don't understand what's happening with that. That's a that's a technical thing that some of their technical people will understand. But I just want you to stick to the fundamentals and understand do not be fooled and sucked back into the vortex right before it collapses.

Brannon Howse: Wow. All right. Speaking of other things in the news last night, I was looking at an article over at my buddy Matt Staver's website. We talked about it and I and he was showing us and we were talking about an article over there. I'm trying to find it again real quick where somebody from the Fed was saying, Oh, I'm not so sure we need a central bank digital currency. Wait a minute. Why is someone from the Fed doubting the need for central bank currency? Is this a is this again another ploy? Is this A, they were saying we think our current system is is adequate. Why would someone from the Fed come out and be saying this?

Rebecca Walser: Don't know. Mean. Plausible deniability that it's some kind of strong-armed position being forced on the American people. If there's some kind of debate, then maybe we feel like the doubters were heard. I don't know. The Fed is, as far as I'm aware, top to bottom, fully on board with the centralized plan. I mean, they are the centralized plan at the US level. Obviously, you know, the United Nations, the Bank of International Settlements, the World Economic Forum is the the the driving force of all of these policies, along with multiple other multi-billion funded NGOs that operate across the world as charities that are political action groups that, you know, run, run a lot of stuff.

Brannon Howse: Look at this headline here, IMF working hard on the global central bank digital currency platform concept. Again, whether it's the World Bank, the IMF, the Federal Reserve, other central banks of the world, they're all working on a central bank digital currency platform. Here is IMF, which of course, I really watch the IMF. I bet you do as well, because of the fact that they had the first digital currency concept or global SDR special drawing rights since 1969. So I watch what the IMF does. And I also, of course, Rebecca, watch how much gold they're buying up. And I and I think IMF has is at least they were. I need to check the latest figures but last year, the year before when I checked and reported on it, they were like the fourth largest holder of gold against some countries. I'm like, well, why is the IMF holding gold? Well, because they know what's coming and they're probably going to have to back a percentage of this central bank digital currency with gold to have anyone even believe in it. Because if your currency is your fiat, currencies collapse because they're not backed by anything, then people are going to say, Well, why would I want your cbdc? Well, it's backed by a percentage of gold. Oh, well, that changes the narrative.

Rebecca Walser: Absolutely. So the IMF is I would call it's a West, it's a product of the West. It is a function of the West. You know, even though the special drawing rights there, there is Chinese yuan and Japanese yen as one of the, you know, two of the five currencies as part of that basket. The IMF is still a Western. When I say Western, you know, I don't just mean the United States. I mean the United States, Europe, Canada, Australia and New Zealand and Japan. Even though Japan doesn't belong in the West, it is a part of the West since World War Two. So basically the IMF is a product of the West and the IMF. Just in a nutshell, this is how the West has commandeered third world countries. In other words, we go in, we will provide all kinds of capital for you. We're going to modernize your wells, your sanitation, all of these things. Right. And then, no, you don't have any money. But what's going to happen is now that you have the infrastructure, the multinational corporations of the world are going to come and invest, you know, into your economy, and then you'll create a tax base with your citizens who'll get jobs. In other words, we're going to Americanize in Europe and eye every third world country in the world. This is the IMF story. This is how they operate. And so they are behind the eight ball. The Bank of International Settlements is actually further along in their crypto platform than even the IMF. So they are playing catch up, which is interesting because you're 100% right. Brannon, They are the one group that has created a cross basket currency that did and was used in the global financial crisis in 2008, and 2009 to stabilize some currencies. So it's actually interesting that they're kind of late to the party here. Well.

Brannon Howse: Correct me if I'm wrong, it's the World Bank that also has gone around and loaned them a lot of money, these third-world countries. Absolutely. And then when they can't pay.

Rebecca Walser: This is a.

Brannon Howse: Tandem when they can't pay their money back. I've read the World Bank when they can't get their money back, the IMF will step in and help them. But they've got to turn a lot of their economic sovereignty over to the IMF.

Rebecca Walser: Well, it's the World Bank is the funder of these types of things that I'm talking about with through the IMF program. So, absolutely. You're looking at both. Yes. And no one's saying that this is a nefarious thing. It could have been all done with the best of intentions. But we do have case studies where it didn't go very well in countries and it was problematic. So we can't just, you know, export, you know, the Monroe Doctrine. We can't just export our philosophy to the whole world and expect that everyone can become America and Europe.

Brannon Howse: Here's a headline. Fed ECB may Slash bank Reserves by 90% In an era of high rates dash paper, the Federal Reserve and the European Central Bank may mop up as much as 90% of the money they. Pumped into banks over the last decade. Now that high inflation and interest rates make that extra liquidity unnecessary. A paper by a Fed economist showed on Thursday. The world's two largest central banks have been raising interest rates at a brisk pace to fight inflation and unwinding some of their massive bond purchases, which flooded banks with cash. When price growth and sluggishness and borrowing costs are already at zero. The Fed paper, which will be presented to top central bankers next week at the ECB's annual Get Together in Portugal, delves into the question of how much cash the Fed and the ECB should keep in the banking system to satisfy the demand for reserves. Now that monetary stimulus is no longer needed. Its author, a senior adviser to the Federal Reserve Board, estimates the Fed could reduce total reserves from their current 6 trillion to between 600 billion and 3.3 trillion, depending on whether it would accept the US government bonds or less covered assets in return. What does that mean in layman terms? Does that mean that some of these banks may be put in a tougher spot for liquidity that they need?

Rebecca Walser: Yeah, this is actually a paper written to answer the problem that they know they're about to have. So it's really interesting. I went back, Brannon, and looked at the analysis from economists in June of last year because it's always forward-looking and I wanted to see what they were specifically saying and I actually concurred with them at the time, which a lot of them, especially the Bank of America team, really put a second half recession that we would figure out that this economy is not good in the second half of 2023. And it would be specifically because liquidity would be dried, dry, have dried up by then, say that past tense. It's really hard. So basically, we sort of expected that the reserves that have been promulgated through Corona and post-Corona would last up until and now we're finally getting to that liquidity crunch moment where we just don't have enough reserves. Now you have the Fed coming out saying, do we need the reserves because we're no longer stimulating? We're just going to be selling our balance sheet off to the tune of $100 billion a month. Because remember, we have a balance sheet that's over $8 trillion, which is completely unprecedented, never, ever, ever happened before coronavirus.

Rebecca Walser: And people need to understand we're in a net negative interest rate situation and will continue to be there and will remain there until we run off this balance sheet, which has interest rates that are you know, so let's say we have over 8 trillion of treasuries. That's paying less than 2% to the Fed, yet the Fed, with their reverse repo overnight competition with the money market is paying over four. So we have a negative net cost from the Federal Reserve to the Treasury Department every month. That's not normal. That doesn't happen. The Fed is costing us money right now. And the biggest problem, of course, is if when we do get this next black swan, the Fed is not coming to bail us out because we already have $8.5 trillion on their balance sheet, we have no opportunity to be bailed out again. And that's, I think, the scariest thing that people don't understand, that everyone expects that the federal government and the United States will come along and save the world. If a pension fund collapses, you'll save California, you'll save Illinois. Oh, something happens over here with the hurricane in Florida. Oh, federal funds. Oh, Texas has, you know, federal funds. Federal. Where does all this money come from? Brennan We don't have it in tax collection.

Rebecca Walser: It's always being borrowed. But we are at, you know, kind of a capacity with what the Fed and the central bank have already done. And of course, we just passed $32 trillion of publicly acknowledged debt. Of course, with our unfunded liabilities, we're closer to way over 100 trillion. So this is just coming to a head. And we knew that it would. And just to quickly touch on Europe, the Bank of England just raised 50 basis points this week. It was expected to only be 25. They raised 50. They are seeing that there's still additional pain coming and that they have to continue to tighten. And and unfortunately, Powell is also, I believe, going to tighten. In July. We just got the housing starts, which had it was 1.6, 1.6 million when we expected only 1.4 million. So we still have these weird pockets of good economic data that the the Fed will use to continue to raise rates. So we're going to see a 25 basis point hike in July, pretty much unless we have some kind of swan event before then. And then I think we'll probably get another 25 basis points in October. And what is that going on?

Brannon Howse: To do to the banks? Because doesn't it doesn't it impact the bank's positions with things they're locked into with certain interest rates? Doesn't it hurt their standing and create a problem for these banks? Isn't that why we saw earlier in the year these banks failing was because of the uptick in interest rates? So are you telling me start expecting to see more regional banks failing in July and later in the year as they tick up these interest rates?

Rebecca Walser: Yeah. I mean, unfortunately, the banking crisis, we knew at the time, you know, we said, Brendan, we didn't know if this was the very beginning of it. It's just going to collapse or it's going to be stymied like it was. It was stymied and it is not resolved. It is a problem that does not have a solution. The solution is that it has to bear through the system. And we don't have a Federal Reserve that can save the banking system. We just don't. We people just we have to wake up. You know, there's no other than God, there's no sovereign that can come in here and fix this mess. And yet, how many it is?

Brannon Howse: How many people took advantage of what they had made available to many of them for the first time? Not you, not me, not this audience. We all a lot of us have been tracking this for years and years and years and, you know, writing articles and books and TV shows and radio shows about it. But a lot of Americans got a blessing. And I told my wife this when it happened. I said this is this could be a real blessing for a lot of Americans if they pay attention. I was talking about these banks failing early in the year and I said, look, if this is the beginning of the end, then there's no chance to do anything. But if these bank failures are stopped and they stop the bleeding and this is you know, there's a moment of pause here before the next wave, This is a real blessing because it is giving a warning to those Americans that are wise enough, prudent enough to see, you know, the Bible says a wise man, a prudent man sees danger and takes refuge, but the fool ignores it and suffers for it. So the person who's saying, Hey, I didn't know about all this, I'm not as smart as Rebecca. I have a job that isn't economically based. And so I don't. I'm sorry. I'm buried trying to just pay the bills, raise my family.

Brannon Howse: Do what you got to do. Yeah, You know the average person, right? But, hey, I saw what went on, and it caused me to start spending some time doing some research. And now I'm thinking to myself. Hey, honey, don't you think we ought to get some of this money out of the bank? Don't you think we ought to put it in a hard asset, something that we have control over versus it going under or getting pennies on the dollar or being inflated away? And then they maybe started realizing central bank dollars, those could be confiscated. I mean, we're going to talk about a bill that's already passed. One of the I think it's the House in Michigan headed to the Senate that could cause you to be fined thousands of dollars or go to jail for a decade. If you say anything that hurts the feelings of sexual minority communities. Now, I've been warning about that for decades. It's called hate crime legislation. Been warned about it because it's in Canada, it's in Europe, in Canada. And if you say certain things and speak the truth about the LGBTQ or transgender agenda, and I'm not talking about the individuals per se, I'm talking about the agenda or the leaders that are really being, I think, co-opted by the cultural Marxists to set up a false narrative and that, hey, this is a coalition of victims.

Brannon Howse: Oh, who are your oppressors? The Christians and the capitalists. Oh, really? Why? Because we just read the Bible and talk. But now that'll be hate speech. To read the Bible. Try reading the Bible in Romans one up in Canada on the air, and you can be in big trouble or speak the truth about Islam and read right from their books. The Hadith, the Quran, you know, the reliance of the traveler. And watch what happens when you start adding commentary to that in Canada, you're going to be in big trouble. So central bank dollars will be very quick to know who's saying what, posting what doing what boom. So I think all of this was really God's. Being gracious to us to get this little warning. But here's the question. I know that's a long lead-up to a question. Here's the question. How many Americans are taking advantage of this warning? In other words, have you seen an uptick in the phone calls to your office of people saying, I just kind of been checked out, but I'm wide awake now and I want to do something? Is that has the events of have the events of January and February awakened many who are kind of in slumber or not?

Rebecca Walser: Well, I mean, we definitely are busier and that probably is a product of Brannon of more interaction with you and getting out the message more this year than even last year. But I do believe that people are people that are awake are becoming more awake and starting to say think something's different. But, the overall general trend, because the people that are awake are such a small minority, you know, a minority of the population, unfortunately. But the majority of the American public did was leave the regionals and go to the big four. And I'm just going to say the big four. I'm going to say who they are because people need to know these are the big four banks in this country and these are multinational corporations.

Brannon Howse: Can I guess?

Rebecca Walser: Yeah, please do. Let me.

Brannon Howse: Guess. I may be horrible at this, but I'm going to guess. Wells Fargo? Yep. Bank of America. Yes. Okay. Now, the other two these are just be guesses. Our bank.

Brannon Howse: My other two were the remaining two.

Rebecca Walser: Jp, JP Morgan and Chase and Citibank and Citibank.

Brannon Howse: So I got two of the four. All right. Well, that's a yeah. So that's a failure, by the way, to get two out of four. That's 50%. That's a failure.

Rebecca Walser: So I just want you to put that into perspective, right? If you had people leaving regional banks at a clip that had never happened before, going to the big four. Okay, 330 million, 340, 350 with uncounted. Let's just say not all those people are banking, but let's just say that we have 330 million bankers. Or let's say that's not true, cause we have a lot of unbanked people in this country. So let's say we have 200 million people that bank in America, and most of those people, 60%, let's just say, which is probably, you know, probably low actually bank at the Big four, you know, that's 120 million people. That's 30 million people per bank. Do you think that there's a banking crisis? Is there any corporation on the face of the planet that could service 30 million people within a reasonable time frame? So we are way beyond too big to fail?

Brannon Howse: So you're saying you'll be on the phone forever and ever and ever?

Rebecca Walser: It's impossible. It's physically and humanly impossible. It's called catastrophic. Too big to fail. And this is not where to be. So I would encourage you, if you are a part of the f? the groups that we mentioned that consider a credit union and certainly consider hard assets. Absolutely. All right.

Brannon Howse: Final question if we go too well, hopefully, final question, we go to Patrick Woods. Still got Matt Deperno. Matt Deperno, then Patrick Wood. Roger Stone, you look at this headline, Is the banking crisis being orchestrated? Brand new article out? And I would say absolutely yes. I think that's kind of what we've been talking about. But respond to this one. Does Daily Reckoning have this the biggest monetary shock in 52 years? I recently revealed, writes Jim Rickards, the so-called BRICs plus countries will announce the creation of a new currency at its annual Leaders Summit conference in August. This will be the biggest upheaval in international finance since 1971. It's taking direct aim at the dollar. Quite simply, the world is unprepared for this geopolitical shock wave. It appears likely that the new BRICs plus currency will be linked to a weight of gold. This plays to the strengths of BRICs members Russia and China. These countries are the two largest gold producers in the world and are ranked sixth and seventh respectively among the 100 nations with gold reserves. Comment, please.

Rebecca Walser: So what we've been talking about. Brenham I've been warning about the BRICs nations. I think the first show came on with you. I said, BRICs is where it's at. We got to watch out. And I've been talking about moving to multipolarity in a way for dollar hegemony since the jump. This is it. This is just an absolute nother quiver there. You know, BRICs already had Enbridge, which was their crypto platform to do bilateral transactions between their member nations. But this is this this is a game changer. And we are moving to a world that is, again, hard asset-backed. So as much as all of these 81 countries believe they're moving to central bank digital currencies and they are nationalizing their cash, I think that the world is moving in a different direction and these leaders are the ones that are yet to find that out. And I can't wait till it happens because I know it is going to happen. So I'm excited about that.

Brannon Howse: Folks, if you want to get involved. Walser wealth.com. Walser wealth.com. I'm going to put out the disclaimer. She doesn't ask me to do this, but I don't want her to get frustrated. I don't want my audience members to get frustrated. You're not going to be able to just dial the phone and Rebecca picks it up. It doesn't work that way because her phone rings off the hook. Okay. Number one. Number two, by-laws and licensures and things that she has to go by. She has a clientele that she can only service based on the requirements in the industry that she's certified with. And different groups have different qualifications. Hers is you have to have at least a net worth of 250,000, correct?

Brannon Howse: So if you have that, then you're a qualified investor and you can call and check out what she has to offer at Walser wealth.com call or check out on email Walser wealth.com. I don't get paid to have her on She doesn't pay me to have her on I have her on because I can have a conversation with someone that's tracking what's going on and she helps us understand it and it's a service I offer to my audience in return. I, of course, promote what she does because that's where free market people and we're happy to promote her business, her organization, in return for the time that she gives us here at Workman, is worthy of their hire. So in return for the great information she brings us, we mentioned her website, but I just want to make sure that you guys understand the game rules so you don't think ill of her. If she doesn't return your call or doesn't pick up the phone herself, you then spend time trying to get Ahold of her to find out. Only you don't qualify. So you have to be a qualified investor of 250,000 or more. If that fits your situation, then I would urge you to check out what she has to offer at Walser wealth.com. Now she can help you with all kinds of things, including gold in ETFs on paper. But she I met her through Swiss America West Peters so if you want to do physical however you do join me in recommending Swiss America that's been at this for 40 years, right?

Rebecca Walser: Absolutely. I Love Swiss America. We have a great relationship with them. And just like their educational-based approach, you know, they're really happy to educate clients on what, you know, physical ownership looks like entails. And then obviously they're really good about when the market changes and people want to maybe divest of coins and stuff like that. So I mean, we just really are thrilled with Swiss America.

Brannon Howse: We appreciate that. Thank you. And we look forward to having you with us at the Ozarks conference as a keynote speaker. Who knows what'll be going on by October, Right? But Rebecca, it's going to be exciting.

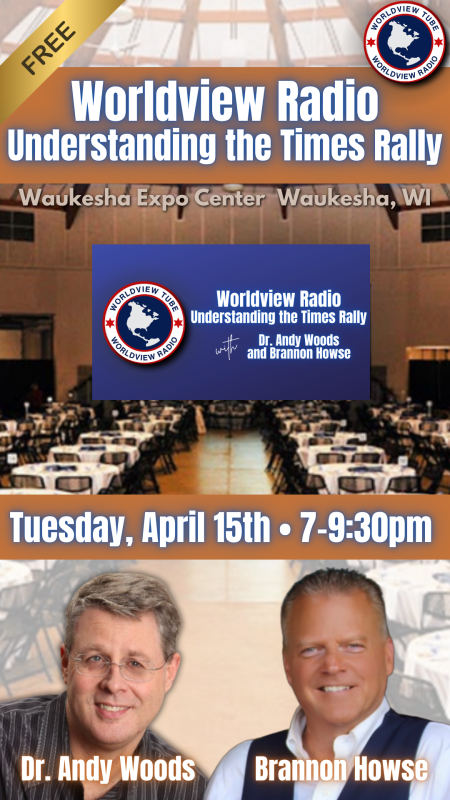

Brannon Howse: Live in person. Rebecca, She'll bring some books. You'll be able to get them a signed visit with her. She's one of many speakers coming up at our Ozarks conference, along with General Flynn, Mike Lindell, Patrick Wood, Andy Woods, Todd Bensman, Alex Newman, Colonel John Mills. It's going to be a big event. It's selling out, folks. It has been the last two years. Secure your tickets quickly at WVWTVstore.com or 901 4689357. Rebecca thank you so much for being with us again tonight.

Rebecca Walser: Thank you. Brannon, Thanks for having me. Have a great one.

Brannon Howse: Rebecca checking in. Her website is Walserwealth.com. Now if you guys want to throw up the graphic for Swiss America, let's do that. If you'd like to get some information on precious metals in physical form Bullion, silver Eagles, Gold Eagles, or numismatic 1933 and older. You can check out Swiss America. Maybe you don't even know what it means when I say numismatic. That's 1933 and older. It provides privacy Under federal law. It's private. And of course, then there are ratings. Miss 60, Miss 61. Miss 62. Miss 63 on up, I think to around 70. And you're like, what does that mean? Well, again, these are things you need to understand in that educational process of doing your due diligence to help you with that. West Peters is offering a free report, no ?? obligation, free report. Just simply text him your name and your phone number and your mailing address. I guess they'll have your number if you text him, text him your name and your mailing address. He will send you that no-obligation packet of information. 6025588585 6025588585. Again 6025588585. And I repeat it because this show is not only on television where people can see the number but it also is turned into a podcast. And you can listen to the days before the program. Every day, like tomorrow morning, you'll be able to wake up and listen to this entire 90-minute broadcast as a radio show at Worldview Radio.com So I mentioned the number so that those watching are listening by radio can pick that up.

Brannon Howse: So please check out what Wes is offering and get that free report. All right. Speaking of radio, take a look at the website as it pops up here. WorldviewRadio.com. WorldviewRadio.com. If you go there, WorldviewRadio.com. As I said, here is my radio show from yesterday right there, Worldview Radio Today show we put up there later tonight. Here is yesterday's Brannon Howse live. There it is for 90 minutes. The TV audio of the June 21st broadcast. Then there's the audio of the Worldview report. So you don't have to watch it. Maybe you have a job where you really can't watch, but you'd like to listen. We do archive these shows each day at Worldview Radio.com as a podcast. We do, of course, have them as TV shows every night. They get loaded as television shows right there at WVWTV.com WVWtv.com already. Here's today's radio show. Michigan is set to outlaw Christianity and 600,000 Americans per year die from Covid shots. In my interview with General Flynn last night. Mike Lindell I have Rachlin all the other shows we carry, Mat Staver interview, all the other shows we carry, like that of Ivan Rachlin's show, The new American TV. We carry the shows of Dan Eastman. There you'll find all those on-demand at WVWTV.com. All right.

Call 901-468-9357 for phone orders or to make a donation

----------------------------------------------------------------------------------------------------

Get your free, no-obligation packet on precious metals by texting or calling Wes Peters with Swiss America at 602-558-8585

----------------------------------------------------------------------------------------------------

Click here and visit www.wvwtvstore.com to order emergency, freeze-dried food that will last 25 years and vital emergency supplies or call 901-468-9357.

----------------------------------------------------------------------------------------------------

Please help us with the huge cost of producing and distributing FREE radio and television programs by making a contribution at www.wvwfoundation.com or by calling 901-468-9357 or by sending your contribution to:

WVW Foundation

P.O. Box 1690

Collierville, TN 38027

Please go to www.Mypillow.com and use the promo code WVW to save up to 66% off and Mike Lindell will give a generous percentage back to WVW-TV to support our free broadcasts.

Editor's Picks

WE'RE A 100% LISTENER SUPPORTED NETWORK

3 Simple Ways to Support WVW Foundation

Make Monthly Donations

-or-

A One-Time Donation

-

Mail In Your Donation

Worldview Weekend Foundation

PO BOX 1690

Collierville, TN, 38027 USA -

Donate by Phone

901-825-0652